Day 1 - 9/23/19

I’ve been managing my portfolio for about a year now, and I’m up roughly 15%.

The market is at 19% ytd right now.

I’ve decided to change up my strategy, and employ a 60/40 portfolio of 40% equities and 60% precious metals, as I believe most equities are overpriced at the moment. Still, I’d like to take advantage of certain events, so I’ve decided to stop memeing and instead place 20% S&P components divided by sector (aka the market), and 20% “Bear Gang Picks.”

Here are my Bear Gang picks:

I feel that these stocks would benefit during an economic slowdown. T pays a nice dividend and alongwith VZ. KMI for that Oil/Energy play. COST because I used to have Kraft in there, but Kraft is a meme while Costco is actually an amazing purchase. BTI and MO because of regulation with vaping and big tobacco. Plus MO is at new lows and vices are probably going to go up after a slowdown.

Generally, I’ll keep these all weighted around this price. This is because 1) I’m lazy and 2) this isn’t really a list, I thought it would be a list but I actually can’t think of anything else. Moving on.

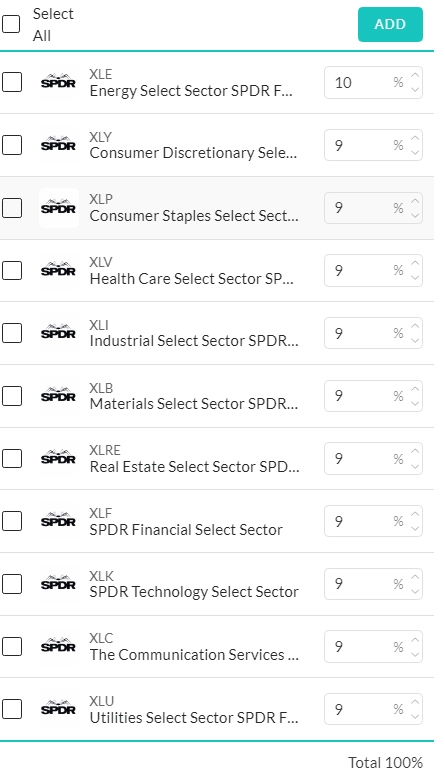

SPX by Sector:

Here’s where things will get interesting. My Roth IRA is somewhere in the thousands, which is kinda small, but I probably will never disclose the exact amount. That 20% is just a few hundred dollars, so each of these funds will have less than $100 invested in them each. Probably less than $50 each, tbh. But fractional shares are a beautiful thing, thanks to M1Finance. I’ve started with weighting all of these relatively equally, except XLE which is at 10% because I’m a degenerate.

Finally, I have a sector called “USD Hedge” :

I called it USD Hedge even though it’s really just precious metals, because I’m treating this as a USD hedge. I believe the Central banks’ easing during the end of a bull cycle signals a triggering of an inflationary cycle, because of the expansion of the monetary supply during times of growth. Traditionally, Precious Metals have been treated as a store of value, and the “traditional” currency.

Here’s what my portfolio looks like:

28.8% is a lie, really. It’s the “money-weighted” return, not the total or actual return. Please disregard that %. I just left it for illustrative purposes.

Don’t trust that 28%, it’s just m1finance and using a weird measuring system. hence the i next to “Return.” It’s really around 15%, thanks for getting into Gold at $1350s or so. It’s now around $1520, for perspective.

Anyways, here’s to whenever I update this next. WHO knows when that will be, because I never do anything consistent ever in my life. anyways peace